Medicare Supplements

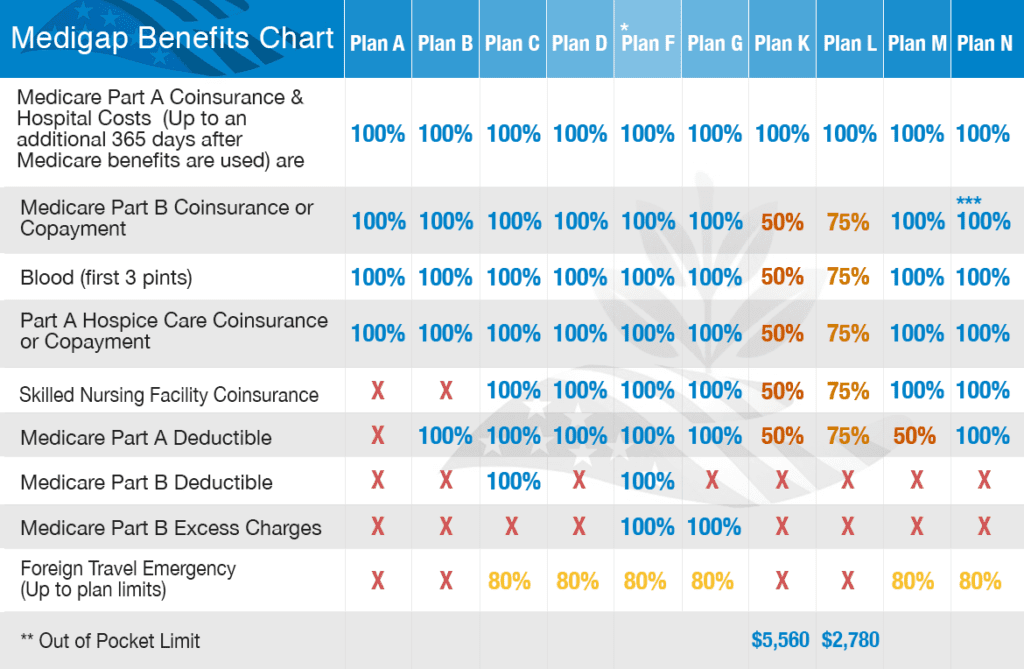

Medicare Supplement plans, commonly referred to as Medigap, fill in the “gaps” that are left behind by Original Medicare. There are ten supplement plans: A, B, C, D, F, G, K, L, M, and N. Each plan covers a certain amount of coinsurance, copayments, deductibles, and excess charges.

What do Medicare Supplements cover?

Plans A and B both provide 100% coverage for:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A hospice coinsurance and copayment

- Medicare Part B coinsurance and copayment

- First three pints of blood

Plan B also offers 100% coverage for Part A’s deductible.

Plan C provides 100% coverage for:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A hospice coinsurance and copayment

- Medicare Part A deductible

- Medicare Part B coinsurance and copayment

- Medicare Part B deductible

- First three pints of blood

- Skilled Nursing Facility coinsurance

- Plan C also offers 80% coverage for a foreign travel emergency

Plan D provides 100% coverage for:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A hospice coinsurance and copayment

- Medicare Part A deductible

- Medicare Part B coinsurance and copayment

- First three pints of blood

- Skilled Nursing Facility coinsurance

- Plan D also offers 80% coverage for a foreign travel emergency

Plan F provides 100% coverage for:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A hospice coinsurance and copayment

- Medicare Part A deductible

- Medicare Part B coinsurance and copayment

- Medicare Part B deductible

- Medicare Part B excess charges

- First three pints of blood

- Skilled Nursing Facility coinsurance

- Plan F also offers 80% coverage for a foreign travel emergency

Plan G provides 100% coverage for:

- Medicare Part A coinsurance and hospital costs

- Medicare Part A hospice coinsurance and copayment

- Medicare Part A deductible

- Medicare Part B coinsurance and copayment

- Medicare Part B excess charges

- First three pints of blood

- Skilled Nursing Facility coinsurance

- Plan G also offers 80% coverage for a foreign travel emergency

Plan K provides coverage for:

- 100% of Medicare Part A coinsurance and hospital costs

- 50% of Medicare Part A hospice coinsurance and copayment

- 50% of Medicare Part A deductible

- 50% of Medicare Part B coinsurance and copayment

- 50% of the first three pints of blood

- 50% of Skilled Nursing Facility coinsurance

Plan L provides coverage for:

- 100% of Medicare Part A coinsurance and hospital costs

- 75% of Medicare Part A hospice coinsurance and copayment

- 75% of Medicare Part A deductible

- 75% of Medicare Part B coinsurance and copayment

- 75% of the first three pints of blood

- 75% of Skilled Nursing Facility coinsurance

Plan M provides coverage for:

- 100% of Medicare Part A coinsurance and hospital costs

- 100% of Medicare Part A hospice coinsurance and copayment

- 50% of Medicare Part A deductible

- 100% of Medicare Part B coinsurance and copayment

- 100% of the first three pints of blood

- 100% of Skilled Nursing Facility coinsurance

- 80% coverage of a foreign travel emergency

Plan N provides coverage for:

- 100% of Medicare Part A coinsurance and hospital costs

- 100% of Medicare Part A hospice coinsurance and copayment

- 100% of Medicare Part A deductible

- 100% of Medicare Part B coinsurance and copayment

- 100% of the first three pints of blood

- 100% of Skilled Nursing Facility coinsurance

- 80% coverage of a foreign travel emergency

Free Consultation

- Get A Quote Now

- We shop the carriers for you

- Speak To An Agent

By submitting this information you acknowledge licensed insurance agents may contact you by phone, email or mail will discuss Medicare Advantage Plans, Medicare Supplement Plans, or Prescription Drug Plans.

When should I enroll?

Once you are enrolled in Medicare Part B, you have a one-time enrollment period of six months to enroll in a supplement plan. During the enrollment period, you cannot be turned down due to any health reasons, nor can you be asked any health questions or charged an extra premium. However, once this enrollment period is over, you may be subjected to health questions or medical underwriting if you try to enroll at a later time